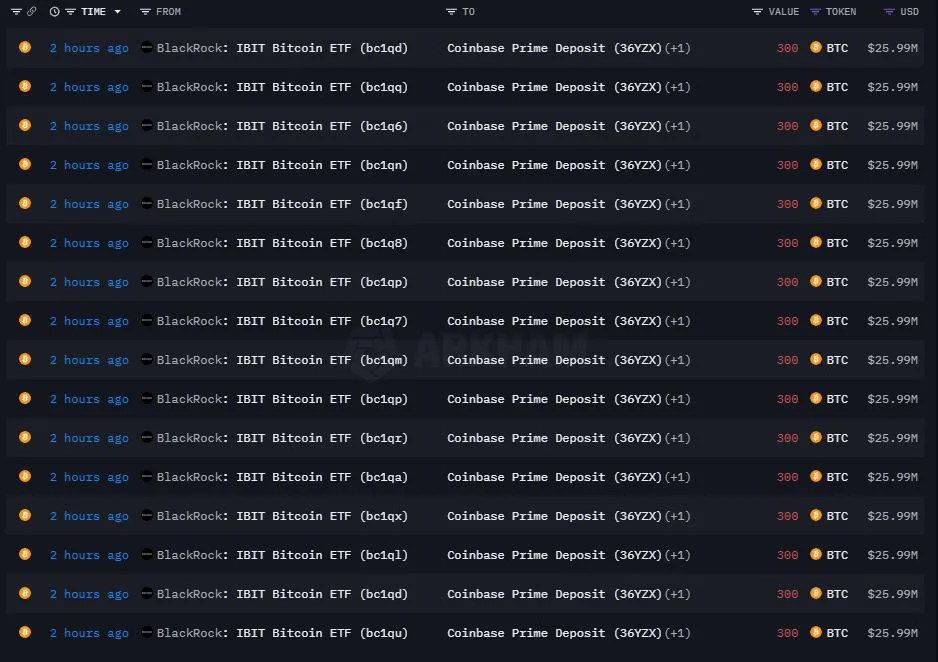

BlackRock has deposited 5,100 BTC worth $441.88M and 30,280 ETH worth $71.85M in a series of transactions into Coinbase Prime. The transactions have sparked liquidation concerns among investors and crypto traders.

BlackRock’s Bitcoin investment firm iShares Bitcoin Trust ETF (IBIT) has transferred Bitcoin and Ethereum in bulk to Coinbase Prime. The transactions are part of a worrying trend that has been going on for some time. Onchain activity shows the Fund has previously executed similar transactions leading to outflows from the ETF.

According to data from blockchain analysis platform Onchain Lens, the Fund deposited 5,100 BTC worth $441.88M and 30,280 ETH worth $71.85M on the full-service prime institutional brokerage platform.

The fund transfer has left many confused if it signals a strategic shift, routine liquidity management, or potential selling pressure. However, the transactions coincide with the ongoing liquidation trend observed in the U.S. Bitcoin and Ethereum Exchange Traded Funds.

According to data from Farside Investors, BlackRock’s IBIT experienced the largest single-day outflows on 26th February. The data shows that IBIT cashed out $418.1 million after selling 5,002 Bitcoin. The transaction marked the third-day streak of negative flows that began on 24th February.

On 25 February, Arkham reported that BlackRock transferred Bitcoin worth $150 million to Coinbase Prime as part of the day’s outflows from the investment firm’s IBIT Bitcoin ETF. An X user reacted to the news, saying that people started regretting letting BlackRock control the market. The user also emphasized that Bitcoin lost its ethos.

Another user added that IBIT has the right to liquidate its Bitcoin holdings and that the Fund has no option but to sell its crypto assets if shareholders sell. A different user gave a similar opinion, saying that BlackRock is not selling or buying anything, but its clients are.

According to CoinMarketCap, Bitcoin has shed close to 12% in the last seven days and 1.32% in the last 24 hours. The crypto asset is down 21.19% from its all-time high price of $109,114 recorded on January 20th after Trump assumed office as the U.S. president. Bitcoin is currently trading at $85,798 as of this writing. The 12.6% drop observed in the first three days of the week marks the largest decline since the FTX bankruptcy in November 2022. A large number of investors are panic selling.

Leave a comment