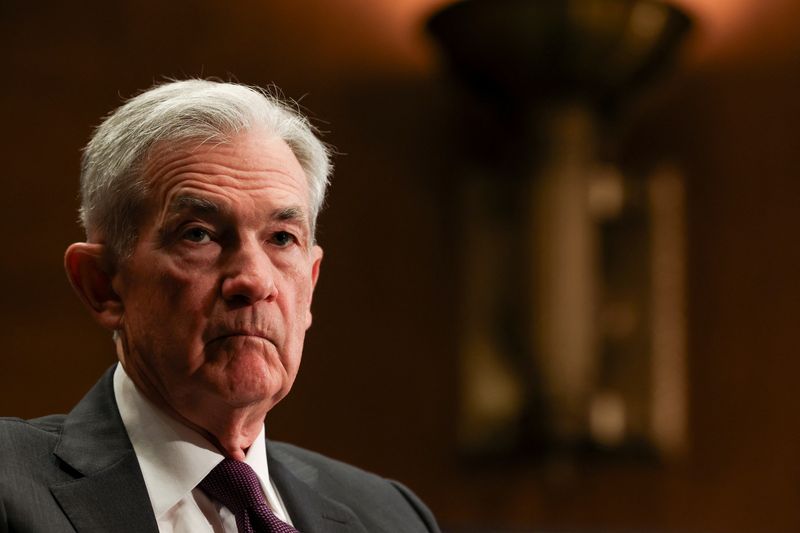

The Dow closed at a record high Friday, as revived hopes for a September rate cut pushed Treasury yields lower and tech stocks higher after Federal Reserve Chair Jerome Powell signaled the Fed was open to cutting interest rates as soon as next month.

At 4:00 p.m. ET (20:00 GMT), the Dow Jones Industrial Average rose 846 points or 1.9% to hit a fresh record close of 45,631.74. the S&P 500 index gained 1.6%, and the NASDAQ Composite climbed 2%.

Powell indicates rate cut is coming

Powell was speaking at the Jackson Hole Symposium in Wyoming, and indicated that the U.S. economy was on sufficiently shaky ground that the central bank may soon need to cut interest rates.

“Downside risks to employment are rising,” Powell said in prepared remarks for his keynote speech at the annual symposium, while the possibility of Trump administration’s tariffs having only a short-lived effect on inflation is “reasonable.”

“With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” he added.

His address came amid increasing doubts over whether the Fed has enough impetus to cut rates in September, however the market now appears to be pricing in two more rate cuts by the year end.

“This is about as explicit a ’we’ll probably cut in September’-type statement as one can expect from the Fed chair,” said analysts at Vital Knowledge, in a note.

“However, while Powell is more dovish than when he last spoke in July, this is hardly an extremely dovish speech on an absolute basis. He is still nervous about inflation and warns that tariffs could generate more persistent rise in prices. In addition, while job creation is cooling, job market slack is NOT due to a drop in labor supply (as a result, the break-even number for the U.S. economy has moved lower).”

The yield on the 2-year Treasury fell sharply as markets nearly fully priced in rate cut odds for September.

U.S.-Canada trade tensions ease

Canada said Friday it would drop most of its retaliatory tariffs of 25% on U.S. goods just ahead of the U.S.-Mexico-Canada agreement review in a few months time.

Canada had imposed the tariffs in retaliation against President Trump’s move to hit the country with 25% duties on steel and aluminum. Canada said, however, that tariffs on U.S. autos, steels, and aluminum would remain in place.

UBS lifts S&P 500 targets; Intel jumps after Trump says U.S. government to take nearly 10% stake in chipmaker

The second-quarter earnings season is now largely finished, and UBS has lifted its price targets for the S&P 500, citing strong second-quarter earnings and improved economic conditions.

The investment bank increased its year-end S&P 500 target to 6,600 and its June 2026 target to 6,800, with the index having closed Thursday at 6,370.17.

Second-quarter earnings season proved particularly strong, with S&P 500 earnings growing at 8%, exceeding UBS’s initial 5% expectation. The “Magnificent 7” tech stocks delivered 30% growth, surpassing the bank’s 20% forecast. The median company beat estimates by 4.5 percentage points, higher than the typical 3.5 percentage point beat.

UBS noted that third-quarter guidance was also positive, suggesting no slowdown in profit growth despite tariffed goods now reaching store shelves.

Elsewhere, Meta Platforms (NASDAQ:META) signed a $10 billion deal with Alphabet’s Google (NASDAQ:GOOGL), the Information reported, which will see the Facebook owner use Google Cloud’s servers, storage, and other services over the next six years.

Meta, along with Wall Street’s so-called AI Hyperscalers, is racing to build superintelligent AI amid growing calls from investors for returns on the hundreds of billions of dollars poured into AI development.:

NVIDIA Corporation (NASDAQ:NVDA) stock fell following a report that the chip designer has asked some component suppliers to halt production of its China-specific H20 artificial intelligence chip, amid increased scrutiny towards the chip from Beijing.

Workday (NASDAQ:WDAY) stock fell after the human-resources software company left its subscription revenue guidance unchanged, apart from a small boost from the Paradox acquisition.

BJs Wholesale Club (NYSE:BJ) stock rose after the wholesale club operator raised its full-year earnings guidance as it reached a milestone of 8 million members.

Intuit (NASDAQ:INTU) stock fell after the software company forecast first-quarter revenue growth below expectations, hit by sluggish performance at its marketing platform Mailchimp.

Zoom Video Communications (NASDAQ:ZM) stock rose after the communications company presented strong second-quarter results and boosted its full-year revenue forecast, showing continued expansion of its enterprise business.

Intel Corporation (NASDAQ:INTC), meanwhile, rose more than 5%, adding to gains this week, after President Donald Trump confirmed that the U.S. is taking a nearly 10% stake in the chipmaker.

Leave a comment